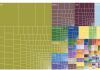

Crowdsourced cell phone signal startup OpenSignal has crunched data on 682,000 devices using its app to produce a visualisation of the diversity of the Android ecosystem. And despite showing growing device diversity — and/or fragmentation, if you prefer to think of it that way — the above graphic really brings home how dominant Samsung continues to be in the Android space.

The Korean mobile maker accounts for almost half (47.5%) of the Android devices using OpenSignal’s app. Compare that massive green square to HTC’s small purple one and the size of the task facing the Taiwanese mobile maker is instantly apparently (although it’s worth noting that HTC’s portion has actually been split up into different regional variants, so its share is not quite so tiny vis-a-vis Samsung.)

The graphic also underlines the power of certain U.S. carriers — with Verizon devices cutting a ZTE-sized chunk of the pie. Google also manages a decent showing for its Nexus-branded Androids, roughly equal to Motorola/Moto’s share — although it’s possible there’s some natural synergies between savvy users of OpenSignal and in-the-know Android fans who buy direct from Google.

OpenSignal’s data ranks the now defunct Sony-Ericsson joint venture brand in second place, as most popular brand after Samsung, with a 6.5% market share — albeit that’s a poor and doubtless dwindling second place, with less than a sixth Samsung’s huge slice — as you’d expect, now that Sony is going it alone in mobile (so also carves out its own, for now smaller portion of the pie).

Despite Samsung’s huge dominance, OpenSignal’s data indicates device diversity in the Android ecosystem is on the rise — which isn’t exactly surprisingly, given Samsung’s strategy of maintaining a growing portfolio of handsets and slates itself, before you start factoring in all the other Android OEMs keeping the platform’s global market share (circa 75%) growing, buoyed by rising smartphone ownership in developing countries.

OpenSignal records a tripling of device diversity vs the data it grabbed in July last year, with 11,868 distinct Android devices spotted this year vs 3,997 last year.

Samsung Flagship Diversity

Looking specifically at Samsung devices, the data indicates the company has successfully managed to spread users across multiple flagships, such as the Galaxy SIII and Note 2, but that has meant it no longer has such a large concentration using a primary flagship. Last year’s data showed the Galaxy SII as a clear leader — of Samsung’s portfolio, as well as of all Android OEM devices:

Whereas the 2013 data indicates that the current Samsung flagship Galaxy S4 has not yet replicated the ‘hero role’ in Samsung’s portfolio that the Galaxy SII was able to attain. That’s not necessarily a bad thing for Samsung, given its iterative device strategy. But it’s an interesting transition none the less, and one which means Android developers need to be thinking about catering to multiple Samsung/Android flagships — even more so than in the past:

All those Androids

OpenSignal also found eight versions of Android still in use among its app users, but well over a third (37.9%) are using the most recent Jelly Bean versions of Android. This compares to closer to a third (34.1%) using the very long-in-the-tooth Android 2.3 Gingerbread version, and just over a fifth (23.3%) using Android 4.0 Ice Cream Sandwich.

As Android is the dominant global smartphone OS platform, it’s not at all surprising to see such huge and growing diversity. Nor is it necessarily such a headache for individual app developers as critics of Android “fragmentation” tend to make out, since most apps are already targeted at particular sub-groups of users in the ecosystem — whether that’s users from a particular region, or a demographic that might mostly use a particular sub-set of devices.

As OpenSignal notes, app context is likely to impact development far more than the absolute diversity of the overall Android ecosystem.

“It is also important for developers to think about the impact of contextual fragmentation, the variety of differing contexts in which devices are actually used. What is relevant for one region may not be to another, and developers need to take into account differences in network performance and reliability when designing their apps — as well as the level of Wi-Fi access for apps which are particularly data heavy,” it comments.

“Another relevant factor is battery life; while one day's battery life may be acceptable in the developed world, it may well not cut it in developing markets. It is important to remember that the criteria against which app performance is judged can change by region, not simply by device.”

ConversionConversion EmoticonEmoticon